One of the perks of being on the Investment Team at EdgePoint is meeting and interacting with interesting people on a daily basis to talk general business. Whether it’s catching up with a management team, meeting end investors or even just hanging out with our 92 internal EdgePoint partners, having the pleasure to talk ideas, markets or the like is a real privilege. Over the last 12 months, people’s business-related attitude and outlook have improved considerably. Maybe it’s the northern hemisphere’s uncharacteristically warm winter that’s lifting spirits, but I believe the more likely culprit is people’s net worth. Stock markets are reaching all-time highs, real estate values appear to be rebounding and people are generally in a good mood.

I like being happy and I like it when other people are, too. I don’t want to ruin the fun on topics like artificial intelligence or weight-loss drugs. Similarly, this isn’t going to be a curmudgeon investor commentary looking for the world to end in order to snag a good deal on stocks, as it’s just not relevant to how we invest. Soft landing? Recession in six months? Shape of the recovery? How long the yield curve will stay inverted? These aren’t questions that affect our investment approach.

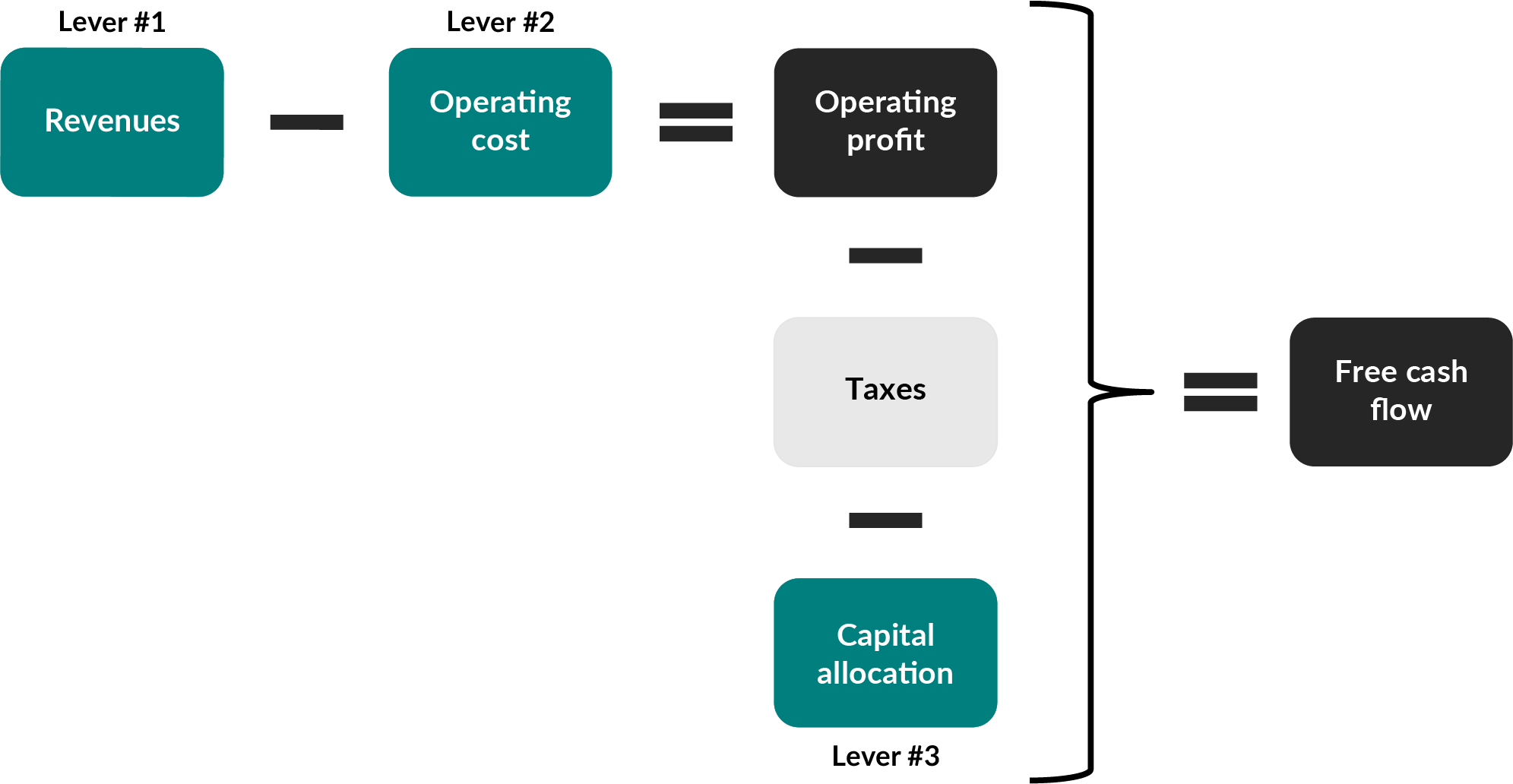

At EdgePoint we distinguish between “themes” and “levers,” separating the stories around a business from the tangible drivers of its value. The 15 of us on the Investment Team spend the majority of our days studying businesses in order to identify change. We try to assess what levers a management team can pull and their durability, as opposed to assessing how much something is going to affect society. As you can see, we’re just trying to think like any rational businessperson would.

Businesses in rapidly growing industries, exposed to particular themes, tend to get the most attention from the investing public. That’s understandable because people love narratives – semiconductors that power the newest technologies make for a far more exciting conversation than a company selling coffee and burgers. However, when assessing the value of a business, growth in isolation isn’t overly useful. What’s far more valuable is understanding the competitive advantage that enables a business to grow, and the durability of this advantage.

There are no shortcuts to learning about a business and the levers at management’s disposal. Deep immersion is required, and we will take effort over IQ any day. Poring over financial information, meeting with management teams and talking to industry experts are all table stakes for what we do.

Fortunately, when everything is distilled down, there are only three key levers to drive a business’ worth, and we’ll discuss those shortly. It’s our job to assess what lever a management team is pulling and determine the sustainability of profits they generate. Occasionally, we have a proprietary insight that’s different than the market regarding the degree to which management is pulling these levers. Stewarded by their management teams, businesses that can act on these levers repeatedly will typically deliver rewards to their investors over the long term.

In our view, there are three key levers in a business:

Revenues

Operating costs

Capital allocation

Revenues and operating costs drive operating profits. After-tax operating profits and capital allocation drive free cash flow. The overall value of a business is the present value of all future free cash flows.

Revenues – why not just earn more money?

In most non-financial service businesses, revenue is a function of volume (i.e., the amount of product/service it’s selling) and the price of that product/service. Certain proprietary insights in our portfolios focus on increasing at least one of these measures.

An example of volume growth is Mattel, Inc.i The idea is centred on being able to monetize a greater amount of its intellectual property, driving volume growth in toys, games, movies and music. Today, everyone only sees Mattel monetizing Barbie and Hot Wheels. While these are its two largest brands, Mattel literally has hundreds of others that are being underutilized. When current CEO Ynon Kreiz took over in 2018, he asked a team to produce a list of brands that they believed were currently being under-monetized. The team sent him a list 11 pages long! The market remains skeptical and seems only to be interested in hearing about how Barbie and Hot Wheels are growing. We believe toy brands should generate roughly $1 in non-toy sales for every $1 in toy sales. To that extent, we remain excited by Mattel’s prospects. The next few years will include movies for Masters of the Universe, Polly Pocket, Barney, Major Matt Mason, Rock’em Sock’em Robots, Uno and several other properties.

Another example is Dollar Tree, Inc., a popular discount retail chain with strong brand affinity and high customer loyalty.ii Rather than growing volumes, our main insight is focused on “breaking the buck.” Dollar Tree was known for selling products at a fixed $1 price point, but in 2021 it significantly shifted its pricing strategy by selling products at higher prices. This move marked a departure from the company's longstanding business model and allowed Dollar Tree to offer a broader, more diverse product range to customers. Moving beyond the $1 price point not only helps its revenue grow and better leverages fixed costs (e.g., labour and rents), but the Dollar Tree banner can attract a wider customer base and meet more of their shopping needs. We also believe with a broader (and potentially higher quality) selection of products, customer satisfaction may improve. Higher revenue and profits allow for greater reinvestment into the company. Funding store improvements and innovations can further strengthen the brand and drive even greater customer loyalty. The discount retail category is mature, but we still see Dollar Tree growing largely through a pricing opportunity. The market is currently discounting it because they believe Dollar Tree’s price point will hover around $1.50. We see no reason the average item can’t grow well beyond that level, especially as the current management team begins introducing products priced as high as $7 per item.

What’s important to underscore is that a company doesn’t need to be in a rapidly growing industry to create a lot of value. In fact, a recent report from Raymond James found that more than 40% of stocks in the top-performing decile over a decade grew their year-one sales less than 5%!iii Having a proprietary insight about why a company can grow and acknowledging the durability of that growth has historically led to better results than just identifying companies in rapidly growing industries.

Top-decile performers – year 1 sales growth

Operating costs – bigger changes may result in bigger savings

While revenue growth gets a lot of attention, improving operating costs can be a key driver of shareholder value. These efficiencies span business activities from raw-material acquisition to the sale and distribution of goods or services. In general, companies achieve improvements in operating costs in two fundamental ways: either they reduce costs within activities, or they significantly reconfigure them.

Most shareholder-oriented businesses continually improve their operations and look to reduce costs. For a manufacturing-oriented business, terms like Six Sigma or LEAN should be common speak amongst the engineering team. It’s rare to find a proprietary insight in a business that simply focuses on continuous improvement. However, occasionally, we find a proprietary insight around a business that has the opportunity to reconfigure its activities, thereby lowering its overall costs.

Take, for example, Norfolk Southern Corp., one of the two largest railroads in the eastern United States.iv Given limited cost-competitive alternatives to shipping large products such as bulk commodities, railroads have proven to be very good businesses with pricing power typically exceeding inflation. Most railroads in North America have undergone an operating model shift. Historically, a train would run only when it was fully utilized. The railroad operating model transitioned to one where trains run at scheduled times. By operating on a set schedule, a railroad can decrease its operating costs by allowing for greater predictability and less unproductive idling.

Today, Norfolk Southern operates under a more legacy, hub-and-spoke system.v That’s expected to change as it adopts a scheduled system that looks more like its peers such as Canadian National, Canadian Pacific, CSX and, most recently, Union Pacific. We believe the opportunity to improve profitability for Norfolk Southern under a scheduled point-to-point system is far more immense than what the market is currently discounting.

Managing operating costs is a key lever in driving business value. When analyzing businesses from the perspective of future business value, it’s important to underscore that improving profitability is more important than high-but-stagnating profitability. Case in point, the previously cited Raymond James report found that 85% of stocks in the top-performing decile over a decade experienced expanding operating profit margins.

Top-decile performers –

change in earnings before interest and taxes (EBIT) margin

Cohort start to cohort end

Capital allocation – making your money make money

Revenues minus operating costs equals operating profits. But just as important as understanding the revenue and operating cost levers is knowing what management plans to do with its profits. In general, if a management team has compelling investment prospects, it should invest these operating profits. Conversely, if return prospects appear average or below average, it should look to return these operating profits to shareholders. The EdgePoint Investment Team spends a considerable amount of time with management teams trying to understand precisely what a company plans to do with the money it makes.

While the majority of business media attention is on “growth” companies that have opportunities in front of them by investing in their own business operations, there are a number of additional ways a management team can create value. This includes businesses making shrewd acquisitions or even repurchasing stock when it’s trading for less than it’s worth.

One business in Cymbria that’s demonstrated an ability to reinvest its free cash flow at high returns, sustainably and primarily through acquisitions, is Berry Global, Inc., a leading global packaging company.vi Stable demand for consumer packaging, combined with high customer switching costs, has led to very consistent and predictable operating profits for Berry. Over its history, Berry has taken these operating profits (with the help of some additional debt or equity) and acquired over 45 different packaging companies. Berry can increase a packaging company’s profitability margins by 5%, largely through its scale advantage. Berry’s size allows it to procure resin cheaper than its competitors, making it the low-cost producer.

The combination of buying companies at attractive valuations and further improving upon its business has led Berry to allocate capital at high rates of return. Today, it demonstrates attractive returns on capital, currently earning a ~14% pre-tax unlevered return on capital employed.vii In turn, with the benefit of some leverage, Berry has been able to grow its adjusted earnings per share by 20% since 2015. While the market believes Berry’s growth will be significantly lower going forward, we see things differently. The packaging space remains highly fragmented, and we believe Berry’s scale advantage should allow for the company to continue deploying its free cash flow into acquisitions for decades to come. This will not only give Berry an opportunity to sustain attractive returns on the capital currently employed, but more importantly, the potential to earn attractive returns on incremental capital and, in turn, drive free cash flow growth and business value.

Ideally, when investing, not only do you want to find a business that earns attractive returns on capital, but more importantly, you want the business to earn attractive returns on new capital deployed. Going back to the recent Raymond James study of the top-decile stock performers, the vast majority experienced improving returns on capital. For example, 50% of the top-decile performing companies had initial returns on equity of less than 20%, but after 10 years, more than two-thirds of these businesses had returns on equity higher than 20%. These management teams have clearly got capital allocation right! Cymbria portfolio companies will hopefully produce similar results into the future.

Top-decile performers –

change in return on equity (ROE) from cohort start to end

Cohort start to cohort end

Source: Raymond James, “How to Find, Hold, or Build Top 10% Long Term Equity Performers”, Raymond James Institutional Equity Strategy, March 5, 2024.

Show, don’t tell

While it’s fun to learn about emerging trends and think thematically, it’s just not how we spend most of our time at EdgePoint. Ultimately, a business value is the present value of future free cash flows. To understand what future free cash flows may look like, a thorough understanding of a business and its levers is essential. We spend our time analyzing them, hoping to come away with a proprietary insight on one of them that we can capitalize on for you, the end investor. There are certain periods where themes prevail and ultimately uplift portions of the market beyond levels that are difficult to comprehend to a rational businessperson. Fortunately, we’re not required to have an investible opinion on everything. Rather, we’re committed to our approach of having proprietary insights on the businesses we own. We invest our money right alongside yours.viii History suggests that over longer periods of time, aggregate results should be pleasing on both an absolute and relative basis. Thank you for your trusted partnership.