Every year around this time our inboxes are flooded with emails from all the major banks and research houses telling us what the outlook is for 2025.

Each email has a similar format. The strategists talk about things like uncertainty, macroeconomic risks, volatility and fat-tail risks, then they tell us if the market is cheap or expensive based on their earnings forecast for the year.

It seems like a series of impossible asks – describe all of the reasons why predicting the market over the next 12 months is nothing more than a coin toss, estimate the earnings for each company in the index over that same timeframe and then make a buy or sell recommendation based on their calculated earnings multiple (i.e., the current price-to-earnings, or P/E, ratio).

I used to feel sorry for all the strategists on CNBC putting their neck out publicly with their sophisticated-sounding guess work, but it turns out you can make a good living doing it and the market is pretty forgiving when it comes to mistakes.

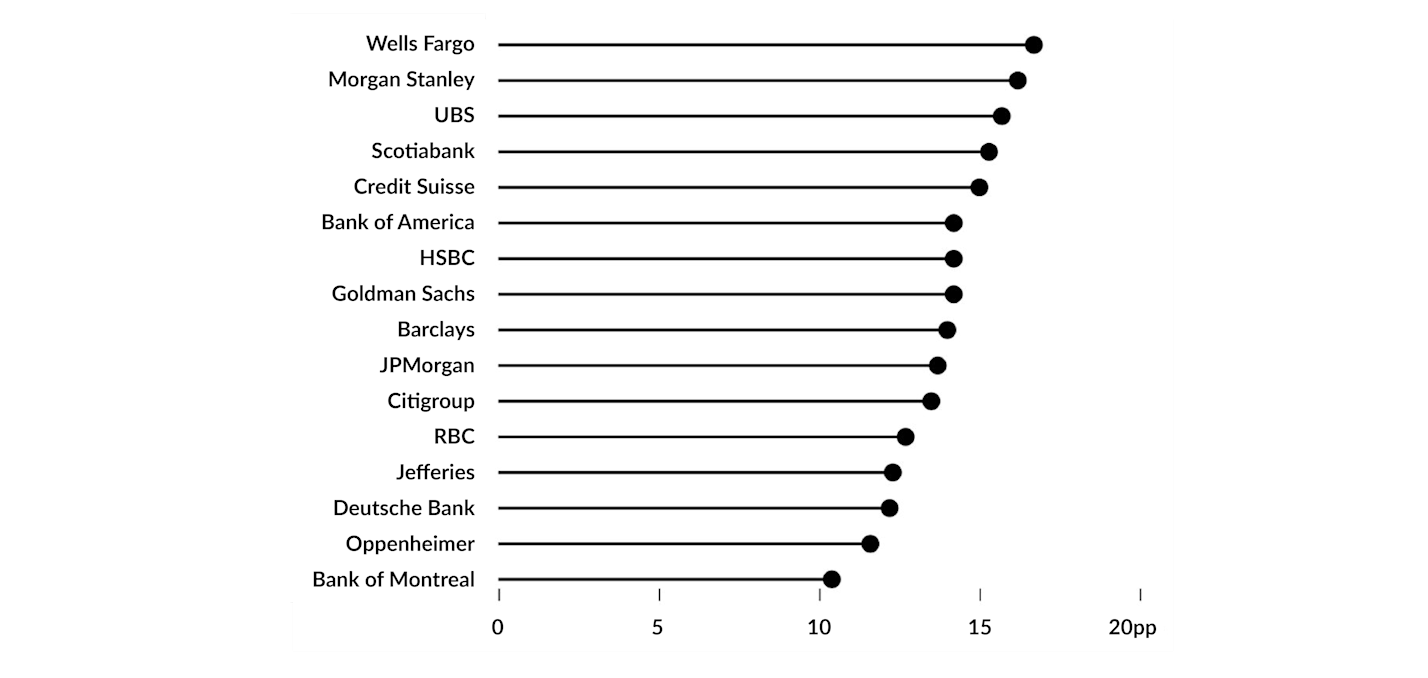

At the end of 2024, Bloomberg analyzed 25 years of data and found that these forecasts missed their mark on average by more than 15%. Even the best ones missed by more than 10%.

S&P 500 Index return predictions – average absolute percentage-point error by firm

2000 to 2024

Source: Alexander McIntyre & Mathieu Benhamou, “Wall Street’s Market Forecasts Are Out For 2025 – Be Dubious”, Bloomberg.com, December 20, 2024. Data as at December 17, 2024, with 2024 data annualized to the end of the year. The S&P 500 Index is a broad-based market-capitalization-weighted index of 500 of the largest and most widely held U.S. stocks. The index is not investible.

A predictable investment approach?

Thankfully at Cymbria, long before my time, the Investment Team knew that there were better ways of getting end clients to their investment goals (what we call their “Point B”) than investing their money based on our own personal crystal balls. Since the very beginning, our approach has been looking at a business like a rational business owner and investing in those where we believed we had a “proprietary insight.” It’s another way of saying that we look for positive changes in a business before they become obvious to others.

It's a “deceptively simple” approach, so I was surprised by a recent question we received about two of our largest holdings:

“How can the same portfolio own one stock at 9x earnings and another at 50x?”

It’s an easily answered question for anyone familiar with Cymbria because we apply the same approach that’s been used for over five decades.

Cymbria and the EdgePoint Portfolios are made up of businesses that we believe have attractive long-term growth prospects, but for some reason that growth is misunderstood by the market today. We believe that allows us to pay less than the future value of the business under a range of different scenarios. Investment decisions aren’t made on a 12-month forward P/E. Like our clients, our time horizon is longer and that allows us to ignore near-term uncertainty to focus on the true value of the underlying business.

But sometimes we take for granted the simplicity of our approach. In a world where investor time horizons keep getting shorter and shorter, and the only thing anyone wants to talk about in the financial media is what is happening here and now, it’s understandable that investing like a rational business owner might be a novel concept to a new investor.

So, let’s look at two companies in Cymbria to help explain things:

| Company | Fairfax Financial Holdings Ltd.* | SAP SE* |

|---|---|---|

| Business | Property & casualty insurer | Mission-critical software provider |

| P/E ratio | 8.9x | 50.7x |

| Cymbria rank (weight) | 9th (2.85%) | 10th (2.27%) |

Under a typical “style” approach, these businesses shouldn’t both be among Cymbria’s top-10 holdings. They do share something in common: our proprietary insight. We had an idea about how each could grow in the future and why we could get some of that growth for free.

Fairfax was undergoing a transformation, shifting from lumpy cashflows to more predictable ones. Management indicated that they were going to allocate those cashflows at higher rates of return than in the past. Fundamental improvements were happening in the business, but investors still remembered the old Fairfax and weren’t appreciating the positive changes we saw underway.

In SAP’s case, we thought the potential value creation that would come from having its software transition to being cloud-based was obvious but felt its share price suggested that most investors didn’t or couldn’t act on it because it seemed so far away.

Two very different companies, trading at very different valuations on current earnings. Yet, both stocks approximately doubled in about a year. The market was inefficient at valuing them, and we took advantage of it.

In the entire time we’ve owned both companies, I never heard Investment Team members talk about either company’s current earnings. They talk about the management meetings, industry reviews, conferences and the deep fundamental analysis they did and continue to do, in order to understand how both businesses can be materially bigger in the future.

Each year, Investment Team members meet with hundreds of management teams and attend dozens of conferences, site tours and factory visits. We talk to suppliers, customers, industry experts and competitors. And we comb through financial statements, shareholder letters and investor decks, all to build a mosaic of information that eventually led to an idea like Fairfax or SAP.

Not-so-fearless forecasts

In the spirit of our consistent willingness to look different, I won’t make predictions for 2025 on things beyond our control. Instead, I can give you the outlook for what you should expect from the Investment Team.

We will continue to do the investigative research around the globe that you would expect us to do

In 2024, we travelled across Europe, Canada, the U.S., Mexico and Asia. On-site due diligence included a tour of miniature ball-bearings plant in Japan to traveling to Milwaukee, Wisconsin to play around with Milwaukee tools.i We went to the Mattel Inc.i offices and met the people behind the products and films tied to their intellectual property. Investment Team members took planes, trains and automobiles to reach these destinations. These are a few examples of the on-site work we did, but doesn’t include all the management team meetings or the pages of earnings reports, transcripts and industry reports that were read.

We can’t predict where the search for proprietary insights will take us in 2025, but we promise to do the work necessary to continue finding them.We will keep finding proprietary insights…while we wait for opportunities to employ them

The research we do continuously produces new proprietary insights that the Investment Team monitors while we wait for the opportunity to apply them. When we connect enough dots to generate an insight, the goal is to find it attached to a business we know we want to own – one with good management, a sustainable competitive advantage and a long runway to grow. And the combination of insight and business has to be compelling enough to justify its inclusion over an existing ownership stake. Some of the new names we added to Cymbria in 2024 included semiconductor supplier Applied Materials, Inc., pharmaceutical company Roche Holding AG, life sciences firm Revvity, Inc. and mechanical and electrical component manufacturer MinebeaMitsumi, Inc.i

For 2025 (just like every year), the bar for adding a new name is high. We will continue to review the Cymbria and the EdgePoint Portfolios to capitalize on opportunities like SAP and Fairfax.

We will continue to operate in a narrow emotional band

We believe our primary competitive edge is the combination of our investment approach and our portfolio managers’ adherence to this approach in good times and in bad. Historically, this narrow emotional band has allowed the managers to stay focused on the relevant investment facts to make rational judgements.

Based on some of the irrational valuations that we saw in the market, 2024 was a tough year for the emotionally detached investor, but we are structured to help Investment Team members ignore short-term noise. We aren’t concerned about the career risk of looking different (whether it’s from the industry or an index). We worry about losing money over the long term. Instead of treating a stock like a piece of paper, we view them as ownership stakes in companies where we believe our competitive advantage is sustainable.

In 2025, we will continue to stand apart from the crowd by monitoring the businesses we own (or want to own) to create diversified portfolios of companies with the continued potential to grow.We will work hard to protect and grow your clients’ capital.

Thank you for your trust. We will continue to work hard every day to be worthy of it.

A final prediction on predictions

A wise man once said:

“…short-term forecasts of stock or bond prices are useless. The forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” ii

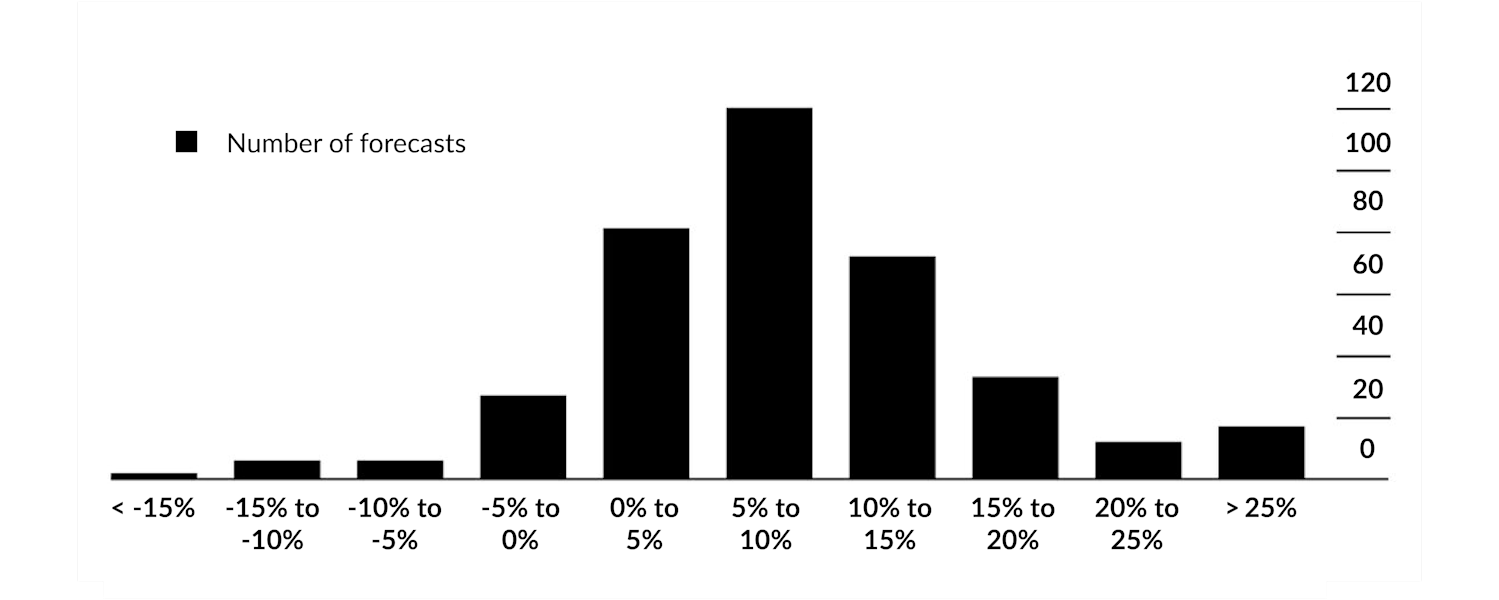

One of the benefits of generative A.I. is that reading all of those predictions individually has now been replaced by a supercharged large-language model search function that can condense them. Based on all the outlooks we received this year, the 2025 P/E ratios for the S&P 500 Index will be 18.5x, 26.0x or somewhere in between. And the index will probably earn 0%. Or maybe 18%.

Predictions for the S&P 500 Index’s 2025 return (number of predictions)

Source: Alexander McIntyre & Mathieu Benhamou, “Wall Street’s Market Forecasts Are Out For 2025 – Be Dubious”, Bloomberg.com, December 20, 2024. Data as at December 17, 2024, with 2024 data annualized to the end of the year. Forecasts made one year in advance.

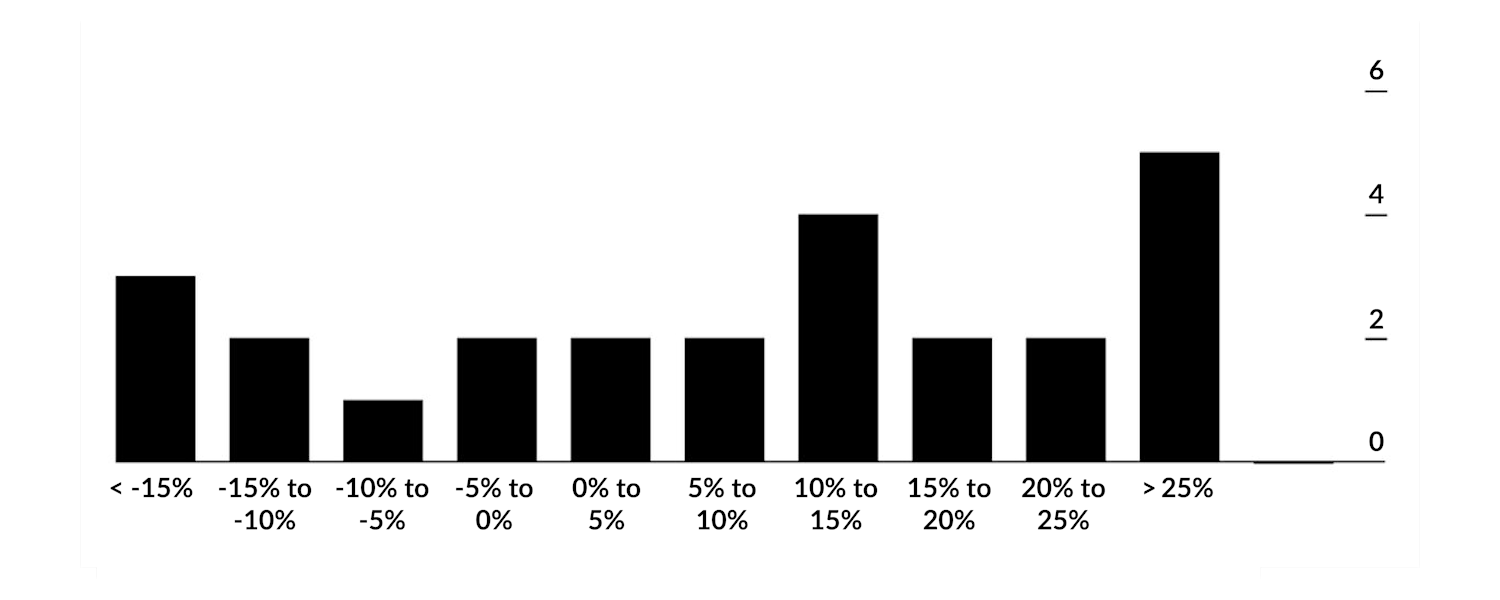

I know that “past performance is no guarantee of future results”, but I thought the actual S&P 500 Index returns since 2000 might provide some useful context as we begin 2025:

Distribution of S&P 500 Index returns

2000 to 2024

Source: Alexander McIntyre & Mathieu Benhamou, “Wall Street’s Market Forecasts Are Out For 2025 – Be Dubious”, Bloomberg.com, December 20, 2024. Data as at December 17, 2024, with 2024 data annualized to the end of the year. Returns are price change only.