Why we can stay calm in the face of uncertainty – 1st quarter, 2022

Here at Cymbria, macro investing has never been our thing. Sure, we follow the news and have opinions on current affairs, but we rarely have a unique insight on the topic du jour that leads to an investment. Unfortunately, we don't have much to add to current headlines regarding geopolitics and inflation. But all is not lost. We have a time-tested investment approach that we work on implementing every day. We find our process becomes more active when fear and doubt dominate the markets. Historically, we have also found that our approach has worked best following periods of uncertainty.

Investing during periods of uncertainty is nothing new for the EdgePoint Investment team. Since Cymbria's inception in 2008, there have been seven notable declines in Cymbria's Class A aNAV.i The following table outlines these periods and highlights the forward returns proceeding these drawdowns. As we can see, while the drawdowns during this period were unpleasing, the returns following these drawdowns have been rather pleasing!

| Date (decline bottom) | % decline | 3-month return | 6-month return | 1-year return | 3-year return* | 5-year return* | 10-year return* |

|---|

YTD: -3.96%; 1-year: 5.44%; 3-year: 7.89%; 5-year: 10.28%; 10-year: 15.13%; since inception (Nov. 4, 2008 to Mar. 31, 2022): 14.50%.

*AnnualizedTotal returns in C$ and annualized for periods greater than one year. Past performance is not indicative of future returns. Cymbria Corp., Class A aNAV. First decline: November 4, 2008 to March 9, 2009. Second decline: April 29, 2010 to August 24, 2010. Third decline: February 18, 2011 to August 19, 2011. Fourth decline: December 29, 2015 to February 11, 2016. Fifth decline: September 4, 2018 to December 24, 2018. Sixth decline: January 17, 2020 to March 23, 2020. Seventh decline: November 9, 2021 to March 7, 2022.

Rather than focusing on macroeconomics, we achieve our results by taking a businessperson’s approach to investing. We’re always on the lookout for well-managed businesses that can grow with sustainable competitive advantages. We only invest in these identified businesses during opportune times when we believe we’re not paying for this growth.

Typically, it’s during periods of high uncertainty that we see an opportunity to buy growth and not pay for it. The most attractive opportunities often appear in businesses with fundamentals that are tangential to the overarching market concerns. However, the business we’ve identified has a unique prospect that we believe will allow the company to grow despite the uncertainty. We refer to these businesses as "non-obvious survivors."

Throughout Cymbria's history, investing in "non-obvious survivors" has been key to achieving our investment results. Near the end of the last quarter and into the first quarter of 2022, the Cymbria's Class A aNAV declined by nearly 10%.ii The actions we have taken within the Portfolio this time around are no different than previous drawdowns. In the first quarter of 2022, we have made a handful of new investments in what we believe are "non-obvious survivors." Given the current ongoing uncertainty surrounding geopolitics and inflation, I want to spend this commentary exploring previous examples of Cymbria's historical "non-obvious survivors" and how this approach has been additive to Cymbria's investment results.

Decline #1 – Global financial crisis (January 2009 to March 2009)

Non-obvious survivor example #1 – BorgWarner Inc.

The global financial crisis is an event that will be forever etched in everyone's minds. The negative implications weren’t just felt in the financial sector but across many industries. The high unemployment rate brought hardship for many families and spurred low consumer confidence. One sector where difficulties were particularly pronounced was the auto sector. In February 2007, before the onset of the financial crisis, U.S. consumers were on pace to purchase 17 million cars. By February 2009, consumers curtailed their auto purchases, and annual sales were set to decline by 50% to nine million vehicles.

The outlook was grim, and Cymbria didn’t have a unique insight into how auto sales would look short term. However, one company in the sector stood out – BorgWarner Inc., a leading producer of advanced powertrain technologies that improve fuel economy and reduce emissions in automobiles. Consumers were looking for vehicles with improved fuel economy given high energy prices. In addition, governments were placing stringent emissions requirements on vehicles. We believed more and more auto manufacturers would turn to suppliers like BorgWarner to address these two trends, irrespective of total auto sales. BorgWarner had a significant lead as it takes three to five years to develop new powertrains, and another three or more years to get "spec'd" into vehicles and ramp production. By having more BorgWarner powertrains in more manufacturers' vehicles, we believed the prevailing trends, when combined with BorgWarner's technological lead, would allow it to grow even in a challenging environment for new car sales.

BorgWarner experienced a sales decline in 2009 owing to declining auto production, but it did remain profitable and solidified our view that BorgWarner would be a survivor. What was less pronounced was how much BorgWarner would be able to grow upon recovery as the fuel-efficiency and emission-reduction trends took hold. In 2010, U.S. annual auto sales were still running approximately 30% below 2007 levels. However, given our proprietary insight into BorgWarner's growth, its 2010 profits surpassed those it earned in 2007.iii Moreover, expectations for 2011 profits were nearly double what the company had achieved in 2007. We exited BorgWarner in 2010 as this "non-obvious survivor" became evident to others, earning a good return and creating value for Cymbria shareholders.

Source: FactSet Research Systems Inc. Total returns in C$. EdgePoint Global Portfolio, EdgePoint Global Growth & Income Portfolio and Cymbria all held BorgWarner Inc. The MSCI World Index is a broad-based, market-capitalization-weighted index comprising equity securities available in developed markets globally. Because the index is a widely used benchmark of the global equity market, we showed its return to provide context for BorgWarner’s performance over the period.

Decline #2 – Sovereign debt crisis (April 2010 to August 2010)

Non-obvious survivor example #2 – Tognum AG

The global financial crisis was especially challenging for the eurozone. Like the U.S., Europe experienced failing banks and rapidly declining asset prices. In addition, several European countries were on the brink of bankruptcy. A sovereign debt crisis was set off when a new Greek government revealed that previous governments had misrepresented budget data. Higher-than-expected deficit levels eroded investor confidence across several other European countries, including Ireland, Portugal, Spain and Germany. This concern negatively impacted equity markets. By June 2010, the MSCI World Index experienced an 11% drawdown in only two months, and the decline was even more pronounced for European businesses.iv

It was a difficult time to be optimistic about the outlook for Europe. However, the EdgePoint Investment team did come across one German company, Tognum AG, that we believed would be able to grow regardless of the economic challenges. Tognum is a market-leading, off-highway diesel engine manufacturer, selling engines and service parts across various industries like power generation, marine and industrial.

On the surface, Tognum appeared to be a highly cyclical engine manufacturer. We saw things a bit differently. We estimated that 50% of Tognum's revenues were non-cyclical, tied to long-term defense contracts, products that had multi-year backlogs or stable after-market sales.

Given the macroeconomic challenges, being optimistic about the outlook for new engine orders was difficult. Fortunately, we saw an opportunity to increase Tognum's after-sales revenues. It had an estimated 400,000 engines in service while it was selling after-sales parts to only 30% of this fleet. We believed there was an opportunity to double this after-sales effort. In addition, we thought there was a margin-enhancement opportunity through greater in-sourcing.

It wasn’t obvious, but we believed Tognum could grow in a challenging European economy, and we weren’t being asked to pay for that growth. Ten months after acquiring shares in Tognum, well-respected U.K. engine manufacturer Rolls Royce also saw the opportunity that Cymbria had identified earlier and acquired Tognum for a 30% premium.v Tognum was now an "obvious" survivor and Cymbria shareholders again benefited from this differentiated, albeit sometimes uncomfortable, approach.

Source: FactSet Research Systems Inc. Total returns in C$. EdgePoint Global Portfolio, EdgePoint Global Growth & Income Portfolio and Cymbria all held Tognum AG. The MSCI World Index is a broad-based, market-capitalization-weighted index comprising equity securities available in developed markets globally. Because the index is a widely used benchmark of the global equity market, we showed its return to provide context for Tognum’s performance over the period.

Decline #3 – Eurozone crisis (February 2011 to August 2011)

Non-obvious survivor example #3 – Ryanair Holdings PLC

By 2011, the European sovereign debt crisis accelerated into a full-fledged eurozone crisis. At this time Ryanair Holdings PLC, the leading European low-cost airline, was already a core Cymbria position. Over the course of the year, Ryanair's share price experienced a peak-to-trough decline of roughly 25%, creating an opportunity for Cymbria to make Ryanair an even more sizeable position.vi

We believed Ryanair would be a structural winner in the European transport space. Its strong balance sheet and low costs would allow it to take considerable share from overleveraged legacy airline peers during the economic downturn. Owning an airline during a financial crisis didn’t appear obvious. Even more "non-obvious" were the fare declines Ryanair was implementing during the troubling times to take advantage of weakened competitors in core European markets. As a result, we believed investors didn’t appreciate the benefits that would accrue to Ryanair from lower competition in the future.

Ultimately, Europe did emerge from the crisis and experienced a travel recovery. Due to this pursuit of long-term profits over short-term ones, Ryanair benefited disproportionately in the recovery. In turn, Cymbria shareholders' patience was met with pleasing returns from Ryanair.

Source: FactSet Research Systems Inc. Total returns in C$. EdgePoint Global Portfolio, EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Portfolio, EdgePoint Canadian Growth & Income Portfolio and Cymbria all held Ryanair Holdings PLC. The MSCI World Index is a broad-based, market-capitalization-weighted index comprising equity securities available in developed markets globally. Because the index is a widely used benchmark of the global equity market, we showed its return to provide context for Ryanair’s performance over the period.

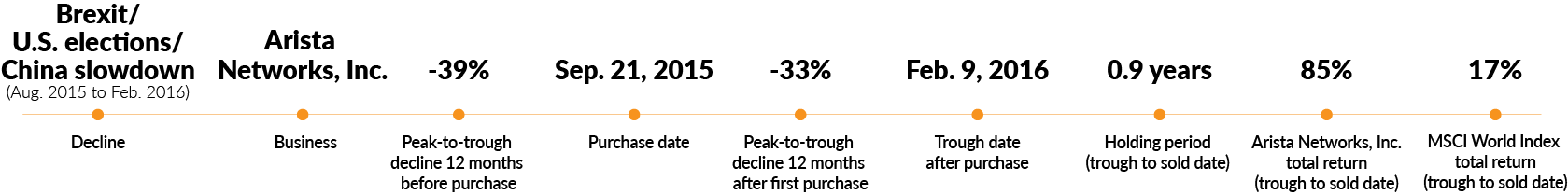

Decline #4 – The everything slowdown (August 2015 to February 2016)

Non-obvious survivor example #4 – Arista Networks, Inc.

The years 2012 through 2014 were rather joyous for equity markets as the global economic recovery took hold. However, by the second half of 2015, there was some early evidence of growth beginning to slow. China and other emerging markets were decelerating, and commodity prices began to tumble. From August 2015 to February 2016, the MSCI World Index declined 11% on fears of another global recession.vii

Buying businesses during this challenging backdrop was "non-obvious" and Cymbria was able to find a variety of different ideas that had considerable growth potential, without having to pay for that growth. One business worth mentioning during this drawdown was Arista Networks, Inc., a leading supplier of cloud networking solutions. The market saw IT spending across enterprises slowing with the economy, taking Arista's share price lower given this view. Its share price declined over 30% between 2015 and 2016.viii

We weren’t convinced that Arista's growth would slow. Its revenues were growing by more than 40% when we first bought shares in 2015, and we believed strong growth was ahead for Arista as companies migrated away from traditional data centres to cloud networks. Supplying cloud networking solutions is very different from legacy ones and Arista had an insurmountable lead. While IT spending may have been slowing, it was "non-obvious" that organizations of all sizes were adopting cloud architectures, resulting in cloud networking seeing unparalleled growth.

The decline from short-term concerns created significant volatility in Arista's shares, but we saw the short-term volatility as an opportunity and increased our position.ix Cymbria shareholders who embraced a long-term businessperson’s mindset benefited as market uncertainty subsided and Arista's strong fundamentals moved to the forefront.

Source: FactSet Research Systems Inc. Total returns in C$. EdgePoint Global Portfolio, EdgePoint Global Growth & Income Portfolio and Cymbria all held Arista Networks, Inc. The MSCI World Index is a broad-based, market-capitalization-weighted index comprising equity securities available in developed markets globally. Because the index is a widely used benchmark of the global equity market, we showed its return to provide context for Arista’s performance over the period.

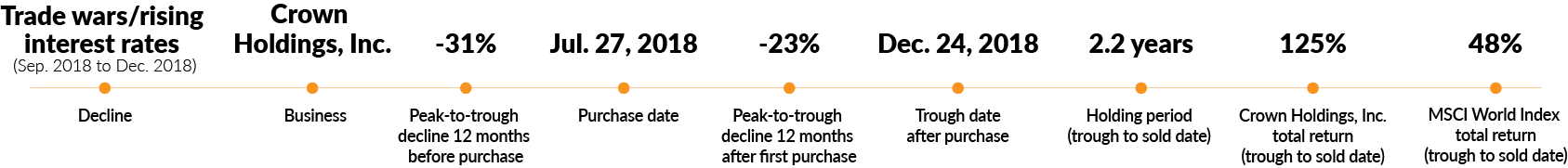

Decline #5 – Trade wars / rising interest rates (September 2018 to December 2018)

Non-obvious survivor example #5 – Crown Holdings, Inc.

Following the concerns of an economic slowdown in early 2016, the market found renewed optimism in the back half of the year and cheered through 2017 as U.S. President Donald Trump signed a sweeping new tax overhaul that propelled equity markets higher. Unfortunately, not all good times last forever and 2018 was a shaky year for investors. Inflation concerns were back in vogue following an overheating economy and trade tensions between the U.S. and China. The U.S. 10-year treasury yield increased above 3%, the highest level in seven years,x driving concerns of greater monetary tightening. As a result, the MSCI World Index plunged nearly 10% in the fourth quarter of 2018, marking the worst fourth quarter since the financial crisis.xi

Through this equity market correction, we found an opportunity to invest in Crown Holdings, Inc., a leading metal-packaging company. On the surface, Crown didn’t appear to be the type of business you would want to own in an inflationary, rising-rate environment. Historically, organic growth was tepid given the maturity of beverage and food consumption. Similarly, Crown historically didn’t have much bargaining power with its customers. It only had a handful of major customers that were multiple times the size of Crown (e.g., Coca-Cola, Pepsi, Anheuser-Busch, etc.). Lastly, at the end of 2017, Crown announced a debt-financed acquisition of a cyclical industrial-packaging business. Low growth, lack of pricing power, increased cyclicality and leverage are generally a bad concoction going into a potential slowdown.

However, we believed many of these concerns were in the rear-view mirror. Beverage-can market share was poised to rapidly increase given consumer preferences for its durability and infinite recyclability. Sparkling waters and seltzers were the fastest-growing beverage categories, and metal cans benefited from this trend. Moreover, new brands entrants further diversified Crown's customer base, giving the company more bargaining power. As a result, North American beverage-can capacity was sold out and conditions were expected to remain tight for several years. This would allow Crown to increase prices above inflation. Lastly, we saw Crown being highly cash generative under any economic scenario, meaning its high debt level wasn’t a concern and could be serviced with internally generated cash flows.

Crown's fundamentals started inflecting in 2019, with evidence of volume growth and pricing power. Patience and conviction in our "non-obvious survivor" approach ultimately benefited Cymbria shareholders. Over the next two years, Crown's business experienced a full perception change into a secularly growing, sustainable-packaging company and our proprietary thesis became obvious to the market.

Source: FactSet Research Systems Inc. Total returns in C$. EdgePoint Global Portfolio, EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Portfolio, EdgePoint Canadian Growth & Income Portfolio and Cymbria all held Crown Holdings, Inc. The MSCI World Index is a broad-based, market-capitalization-weighted index comprising equity securities available in developed markets globally. Because the index is a widely used benchmark of the global equity market, we showed its return to provide context for Crown’s performance over the period.

Decline #6 – COVID-19 pandemic (January 2020 to March 2020)

Non-obvious survivor example #6 – Too many examples to list!

Our commentary a year ago highlighted many of the businesses we had bought during the COVID-19 crash. I won't repeat them, but generally the opportunities we saw all had experienced dramatic share price declines. However, for the businesses we identified, we believed that the disruptions brought on by the pandemic would be temporary and manageable. We also had a view that wasn't widely shared by others for how these businesses could grow over the long term. Thus far, the fundamentals and the share prices of these identified businesses have performed well for us. We exited the positions of the ideas that have become "obvious," while we remain holders of the businesses that continue to be "non-obvious” for now.

Conclusion

As we can see, investing during periods of uncertainty is nothing new for the EdgePoint Investment team. We seek to invest in businesses that we deem "non-obvious survivors” with our time-tested investment approach. As a result, our approach has historically worked best following periods of uncertainty. We expect the periods following the first quarter of 2022 to be no different. During these first three months, we made a handful of investments in what we believe are "non-obvious survivors." While we don't know when these ideas will become "obvious" to the market, we remain highly convinced of our Portfolios' prospects over the long term.

For the most recent standard performance, please visit the Investment results page.