Three years ago, I went to one of my favourite events – a value investing conference in New York. I have attended it annually for over a decade and it brings together some of the best investors in the world.

The 2020 conference felt different. Unlike other years, I didn’t recognize many of the panelists. The highlight of the day is always the Best Ideas Panel. The first investor came on stage and presented an online food delivery company. The next pitch was an online marketplace to purchase vehicles. The pitches were compelling. They laid out the case for how the companies were delighting customers, stealing share from the incumbents and were destined to grow for a long time.

I left the conference feeling uneasy. Was I the only one in the room that didn’t own any unprofitable disruptors? More importantly, I found myself wondering if I was even equipped to evaluate these businesses. Despite already being valued in the tens of billions of dollars, there was no financial history to review, they were losing a lot of money (“profit for later” companies) and you needed to be precise on what the business economics will be in 10 years. Investors seem to be using new math to value these types of businesses – return on capital and free cash flow were replaced by revenue growth and total addressable market (TAM).

I felt like I was being left behind.

OG growth

A lot has happened over the last three years, but our approach to growth investing hasn’t changed.

We look for durable businesses that can be materially larger in the future (growth companies) and try and get the growth for free (value investing). Durability matters because it allows the companies to survive a wide array of outcomes in the near term to grow over the long term.

How do you find growth and not pay for it in the stock market? You need to have an idea about a business that is different than consensus. When we make an investment, there’s often uncertainty about the businesses’ prospects. If there weren’t, the opportunity wouldn’t exist. Put simply, we own a portfolio of non-obvious growth companies.

Sometimes the opportunities exist in high-multiple stocks, other times in low-multiple stocks. The only thing that matters is the quality of the insight – our view of the business’s future relative to others.

Pattern recognition

In last year’s fourth-quarter commentary, we introduced a series of patterns to identify these non-obvious growth companies. This year I want to expand on how these patterns work and use a portfolio company to illustrate.

But before we do, missing from last year’s commentary was an explanation of why these patterns exist and more importantly, why they’re likely to persist.

The stock market is filled with temporary mispricings that get competed away. For example, there was a period when low-multiple stocks (low price-to-earning or low price-to-book value ratios) outperformed the market. Academic papers were written, copycat investors started buying up these “cheap” stocks and the excess returns went away. The same is true for momentum investing or small-cap stocks. Blindly investing in a single factor no longer produces superior returns.

However, the patterns that we have observed are different. They are qualitative in nature which means they’re not easily replicated by a formula. More importantly, they are all based on human nature (misjudgement) which is unlikely to change. At the core of every pattern is a behavioural bias or blind spot that leads to mispricing.

For example, investors miss inflection points because they suffer from recency bias and are anchored to entrenched perceptions. They also have long memories and overlook opportunities because the pain of previous loss overshadows the possibility of future gains.

I want to expand on how we apply some of these patterns to one of our favourite growth companies – Fairfax Financial Holdings Ltd.

More than Fair

Fairfax is a property & casualty (P&C) insurer that we hold across our Portfolios.i The idea embodies many of the patterns that we look for in an investment. The following list isn’t an exhaustive one, but it covers some of the biggest reasons why we like the business.

Pattern – Long-memory stocks

A former market darling that lost its way. The stock price declines significantly, and investors get burned

While long-memory stocks exist in every market, the dynamic is magnified in Canada. The Canadian stock market is very narrow since there’s only a small group of companies to pick from. Institutional and retail investors have an opinion of just about every business. If you have been burned on a Canadian stock in the past, it can take years before you ever look at it again.

Fairfax is the ultimate long-memory stock. It went from market darling to pariah. What should have been a comeback story was missed by investors afraid of getting hurt again.

For the first 15 years of Fairfax’s life, it was one of Canada’s shining stars. The company grew its book value per share (BVPS), a proxy for the change in intrinsic value, from US$1.52/share to US$155.55/share for a compound annual growth rate of 39%.ii The CEO, Prem Watsa, was described by many as “Canada’s Warren Buffett”. By the late 1990s, the stock was trading at 5x BV (an unheard-of valuation for an insurance company).

Just like the internet companies discussed at the value conference, high expectations in the stock market are often a recipe for disappointment. Fairfax was no exception.

The company had a series of self-inflicted issues – first on the insurance side and then later with its investments. While BVPS has grown from US$155/share to US$570/share today,iii the multiple compression (from 5x BV to under 1x BV) has erased almost all the returns for investors.

Fast-forward almost 25 years, the stock price finally surpassed its 1999 peak! An entire generation of investors had a painful experience. Imagine explaining to your clients that after years of losing money with Canada’s Warren Buffett…why this time is different. To avoid the pain, investors have vowed to stay away.

Fairfax Financial Holdings Ltd. share price (C$)

Dec. 31, 1998 to Dec. 31, 2022

Source: FactSet Research Systems Inc.

Fairfax Financial Holdings Ltd. trades in both C$ and US$ on the Toronto Stock Exchange. Fairfax uses US$ in its financial statements.

Pattern – Quality upgrades

A business that’s getting stronger but has gone unnoticed by investors

There are many former market darlings that will never return to their previous glory like Nortel, Blackberry or Valeant. Blindly buying long-memory stocks doesn’t work. You need to find the rare combination – forgotten businesses and improving fundamentals.

Investors are slow to recognize these inflection points. People form strong views about a business and assume that what happened recently will continue forever. If a business is prone to missteps, investors assume it will keep making them. This means that quality upgrades can go unnoticed for a long period of time.

What makes Fairfax a quality upgrade? Its business model is unrecognizable from a decade ago. Fairfax transitioned from a volatile business into a durable growth company. Insurance companies have two main ways of making money – underwriting profits from the insurance business and investing the float.iv Both the insurance and investment engines are the strongest ever and yet few investors are paying attention. Fairfax is one of the most under-owned large-cap stocks we’ve come across.

If you ask an insurance analyst about Fairfax, they will tell you it’s not an insurance company. It’s an investment firm that is masquerading as an insurance operation. That might have been true 15 years ago, but that’s no longer the case.

Investors are missing two important changes:

The quality of the insurance operations is the best in its history, and

The size of the insurance operations has grown significantly.

What changed? For the first 20 years, Fairfax neglected its insurance operations because it operated in an environment with high interest rates that allowed its bond investments to generate very pleasing returns. While the strategy worked because of its incredible investment results, it wasn’t sustainable. As interest rates went lower and bond yields shrunk, the investment profits couldn’t outrun the insurance losses.

In 2011, Fairfax appointed the CEO of its most successful insurance division to oversee its global operations. It also realigned incentives to focus on underwriting profitability and began acquiring high-quality insurance businesses. The results are clear.

Fairfax Financial Holdings Ltd. average annual underwriting profit (%)

1985 to Sep. 30, 2022

Source: Fairfax Financial Holdings Ltd. annual and quarterly reports. *2022 data is as at September 30, 2022, the end of Fairfax’s Q3 2022. Underwriting profit or loss is calculated by subtracting the combined ratio from 100%, the breakeven amount.

Fairfax’s insurance results have been very consistent – it generated an underwriting profit in 10 of the past 11 years,v a period that includes several large catastrophes such as Hurricane Ida, California wildfires and Covid-19.

Just as the insurance results were improving and investors should have benefitted from the turnaround, Fairfax’s investment returns started to sour, masking the progress it was making.

After the financial crisis, Prem was worried about the health of the global economy. To be conservative, Fairfax hedged its investment portfolio. Prior to 2011, its investment portfolio returned 9% to 11% per year, but its hedges dropped its returns after.

Fairfax Financial Holdings Ltd. average annual total return on investments vs. underwriting profit (%)

1985 to 2021

Source: Fairfax Financial Holdings Ltd. annual reports. Underwriting profit or loss is calculated by subtracting the combined ratio from 100%, the breakeven amount.

This turned out to be a costly mistake as the hedges destroyed billions of dollars of value and the company’s BVPS, the proxy for the change in the company’s intrinsic value, stayed relatively flat for five years.

Fairfax Financial Holdings Ltd. book value per share compound annual growth rate (%)

Fairfax learned its lesson and have publicly committed to no longer using equity hedges. We can start to see early signs of progress. Since the hedges were removed, Fairfax’s BVPS has grown at 13% per year. While this is an attractive result, this actually understates its true earning power. The last five-year period includes the drag from lower investment income (discussed later) which has already started to reverse.

Fairfax has also been very thoughtful in how it allocates capital. Starting in late 2020, Fairfax astutely bought a total return swap on its own shares (this is like a share buyback) and followed up with another large share buyback the following year. When the current insurance pricing cycle slows, we think Fairfax will have significant excess capital to aggressively repurchase shares.

Pattern – Non-obvious growth stock

Finding growth in less-obvious places

When you hear the term “growth stock”, you’re probably thinking about sexy industries with secular tailwinds. Software, internet, biotech. Unless you’re an actuary, most people wouldn’t say P&C insurance is exciting. However, Fairfax has a track record of growth that would be on par with a tech company.

Fairfax Financial Holdings Ltd. net premiums earned (US$B)

2015 to 2022

Source: Fairfax Financial Holdings Ltd. annual and quarterly reports.*2022 data is an annualized estimate based on the first three quarters of 2022.

Over the past seven years, Fairfax has almost tripled its insurance revenues. From 2015 to 2018, Fairfax made several large insurance acquisitions (such as Brit and Allied World) and expanded its global insurance footprint. In 2019, we entered into a hard market, a period of time when insurance prices are increasing, and industry profitability is high. We’re currently in the fourth year of the strongest insurance pricing cycle in a generation.

A rising tide lifts all boats, but we aren’t aware of another insurance company that’s taken as much advantage of the strong insurance pricing to grow. Fairfax was the fastest-growing company of the top-25 global insurers last year and did it organically without having to pay a premium to acquire new business.vi

Pattern – Marshmallow management

Company management teams that are willing to stand out from the crowd and defer short-term gratification to increase long-term value

The stock market is an adult version of the marshmallow experiment. Investors generally overweight short-term profits and undervalue companies that are deferring gratification to build long-term value.

One of the core drivers of an insurance company is its bond returns. Insurers collect premiums upfront and pay the claims in the future. They use their float to invest in bonds.

If you’re one of the five regular readers of our fixed income commentaries (you’re welcome for the plug, Frank and Derek), you’ll know that most bond managers outside of EdgePoint achieved extra yield by extending duration during periods of low interest rates. The average P&C insurer has a duration on its bond portfolio of four-to-five years. Fairfax did something radical and kept its duration close to one year. Instead of reaching for yield, it protected its balance sheet. This was painful as Fairfax’s investment income was falling while its peers were showing healthy profits.

Investors are now being rewarded for deferring gratification. In 2022, interest rates have risen dramatically and so has Fairfax’s investment income.

Fairfax Financial Holdings Ltd. investment income (US$B)

2019 to 2023

Source: Fairfax Financial Holdings Ltd. annual and quarterly reports and internal research. *2022 data is as at September 30, 2022, the end of Fairfax’s Q3 2022. ** Internal estimates.

Because of rising interest rates, Fairfax’s peers have experienced large declines in their bond portfolios which has resulted in a 15% to 30% reduction in their cumulative net worth (book value). Conversely, we think Fairfax will finish the year without experiencing any decline in its book value, an extraordinary feat.

Insurance company book value change year-to-date (%)

Dec. 31, 2021 to Sep. 30, 2022

Source: Internal research. In local currency

In addition to protecting its downside, Fairfax has the most upside from rising interest rates. Its investment income is now at a run rate of US$1.2 billion,vii the highest in the company’s history. If interest rates stay flat, we wouldn’t be surprised to see Fairfax’s investment income grow to US$1.5 billion next year, almost triple what it was just a few years ago.

Checking our math

Despite being the fastest growing P&C insurer and having the most upside to rising rates, Fairfax continues to trade at a depressed valuation. The business is selling for less than 1x BV and a 15% earnings yieldviii (if the business doesn’t grow, that would be your annual return). You don’t need to do any fancy math about growth rates or unit economics in 2028 to see that Fairfax is mispriced.

How does Fairfax’s valuation compare to its peers? U.S. commercial insurers trade for 1.5x to over 2x BV. Fairfax, despite having a more attractive growth profile, trades at a fraction of that. What should a business that can generate mid-teens return on equity trade for? We don’t need to get out our calculator to believe that it should be worth a healthy premium to book value.

An interesting exercise is comparing Fairfax in 2015 versus today. Over the past seven years, Fairfax’s stock price is up a modest 23% and its share count is essentially flat. However, the two most important drivers of profitability, premiums and investment income, are up significantly. Each share gets you 2.8 times more premiums and 2.2 times more income. Looking at this chart, something doesn’t add up.

Change in Fairfax Financial Holdings Ltd. share price vs. per share insurance premiums and investment income revenue

Not the same-old story

While Fairfax’s stock price has rallied from its Covid lows, we continue to think its future prospects are bright. Fairfax is a growth company that’s hiding in plain sight. Fortunately for us, misconceptions still happen and that’s why we can find opportunities in the market.

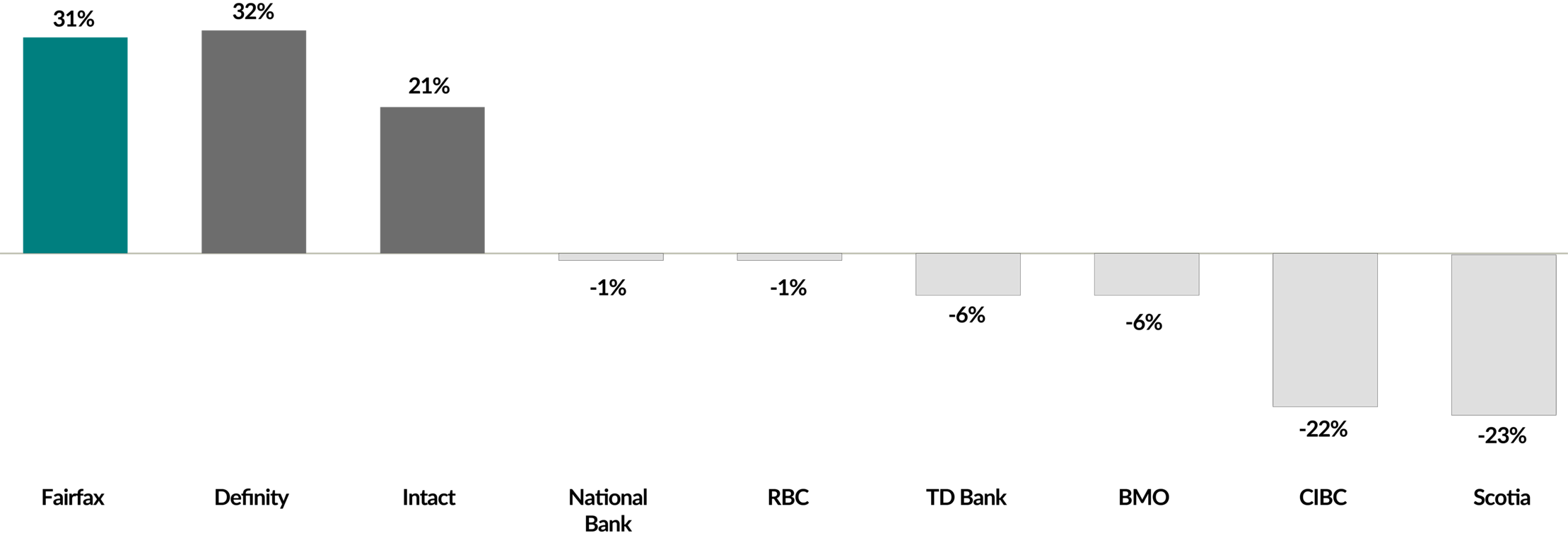

Even newspapers are susceptible to these mistaken beliefs. At the end of 2022, a Globe & Mail article gave a glowing review of two insurance companies, Intact Financial Corp. and Definity Financial Corp., both companies that we have owned in the past, and how their shares beat out the Big Six banks, the gold-standard for investing in Canada.

Source: FactSet Research Systems Inc.

Unfortunately, the article omitted one company with a $20 billion market cap:

2022 total return (C$)

Source: FactSet Research Systems Inc.

While adding Fairfax in would have made their story even stronger, we can’t blame them as we’re sure they only included the Canadian insurance companies they could remember.