When EdgePoint turned 10 years old in November, my colleagues and I travelled across the country to meet with many of our long-term partners. It was interesting to reflect on the events of the past decade.

During these conversations, one question was asked repeatedly: “What are the next 10 years going to look like?” Unfortunately, “we don’t know” isn’t a very satisfying response! Of course, 10 years ago the answer would have been the same – we had no crystal ball then, and still don’t.

In this commentary, we’ll address another important question that almost never gets asked, but should:

What is NOT going to change over the next 10 years?

In reality, knowing what’s not going to change is far more valuable to investors than trying to predict the future.

So, what’s not going to change over the next 10 years? Let’s look at four different certainties.

1) Investors will still be their own worst enemies.

Investor behaviour is not going to change. Humans are not wired to be good stock market investors.

We get caught up in the short-term noise of the market and succumb to our emotions when making decisions. Many investors use stock prices to guide their behaviour. When prices are high, they get excited and when prices drop, they panic.

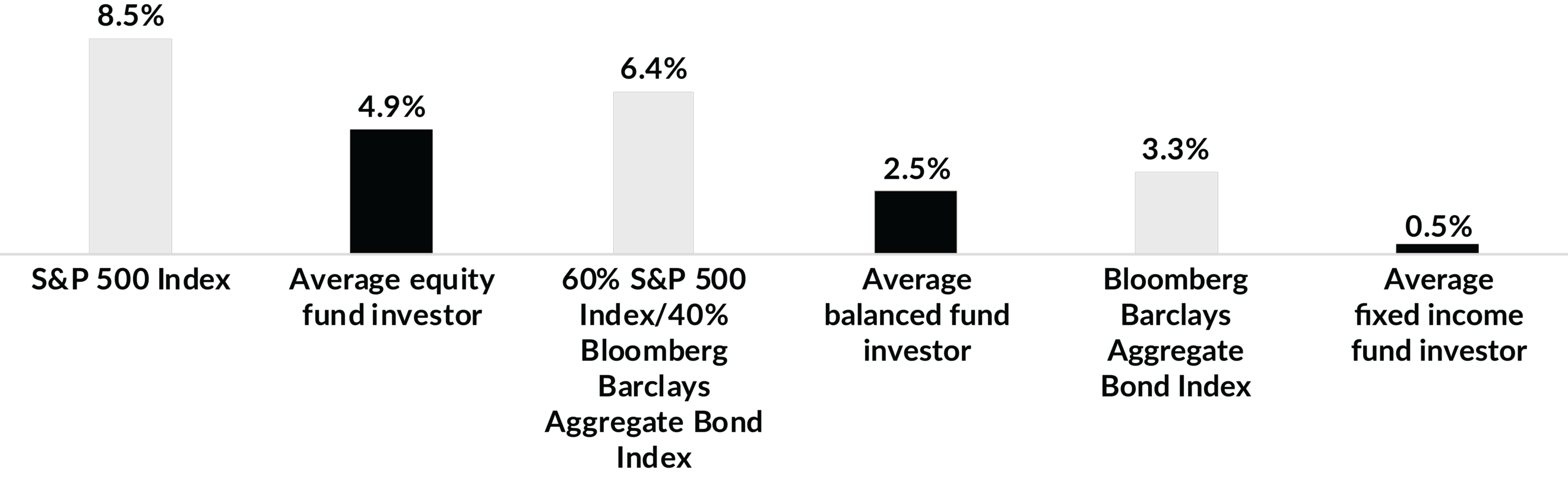

A study by the Dalbar Institute makes it very clear: the average investor consistently performs worse than the overall market. From 2007-2017, the S&P 500 Index returned 8.5% per year, compared to a return of just 4.9% per year for the average investor.

Average investor vs. index returns

Dec. 31, 2007 to Dec. 31, 2017

Source: “Quantitative Analysis of investor Behaviour, 2018", DALBAR, Inc. Returns as at December 31st, 2017 in US$. The average fixed income fund investor is comprised of a universe of fixed income mutual funds, which includes investment grade, high yield, government, municipal, multi-sector, and global bond funds. It does not include money market funds. The average balanced fund investor is comprised of a universe of funds that invest in a mix of equity and debt securities. The average equity fund investor is comprised of a universe of both domestic and world equity mutual funds. It includes growth, sector, alternative strategy, value, blend, emerging markets, global equity, international equity, and regional equity funds. The S&P 500 index is a broad-based, market-capitalization-weighted index of 500 of the largest and most widely held U.S. stocks. The Bloomberg Barclays Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, US$-denominated, fixed-rate taxable bond market.

What causes this? Unfortunately, investors tend to jump in and out of their investments at precisely the wrong times. They pile into funds that have been performing well and redeem at the first sign of underperformance. Buying high and selling low eventually leads to the poorhouse.

That was then – this is now

When EdgePoint started in November 2008, investors were fleeing the market en masse. It was impossible to know how long the financial crisis would last or whether stock prices would move higher or lower in the short term (it turned out they were heading a lot lower!). We believed then, as we do now, that when everyone else is panicking, it’s usually a great time to invest.

Fast forward 10 years and nothing has changed. At the first signs of volatility people are panicking again. Mutual fund redemptions were US$56 billion for the week ending December 19, 2018 – the biggest outflow since October 2008.i

It’s difficult to predict stock market returns over the next year, or even the next few months. But if history is a guide, investors racing for the exits today will create opportunities for those investors who stay the course and don’t panic.

2) In investing, uncertainty is the only certainty

There will never be an ideal time to invest.

When people think about past events, they remember them as if they were less complicated than they really were. We tell ourselves simple stories that make the past seem more orderly.

Let’s take the narrative of EdgePoint’s birth. The simple story is that launching a fund company in November 2008 was the perfect time.

Here’s a list of things that gets forgotten:

We were in the early stages of a global financial crisis with no idea how long it would last or what the impact would be.

Tye, Geoff and Patrick travelled across the country to meet with prospective investors, only to find empty meeting rooms.

Cymbria was the largest initial public offering on the Toronto Stock Exchange in the fourth quarter of 2008.ii

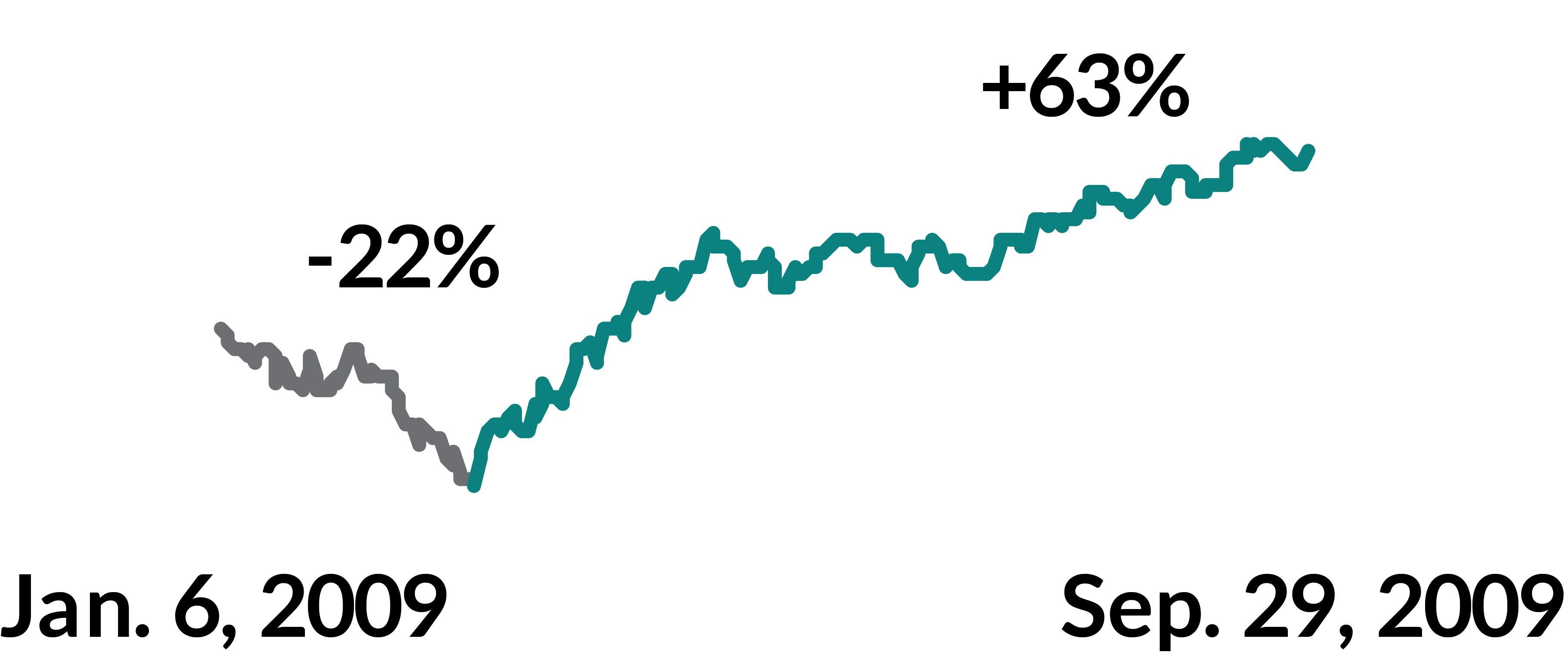

We invested the portfolio in November 2008, thinking it was a great time to invest. Early investors were rewarded by seeing their Global Portfolio drop -22% between January 2009 and March 2009.iii

Employees had to take a significant compensation haircut and didn’t know whether the company they were joining would ever be profitable.

That was then – this is now

Investors who are selling equities today likely believe that the future is uncertain. Newspaper headlines are intimidating with fears of a slowing global economy, trade tensions with China and slumping commodity prices.

The truth is there are always things to worry about. When we think back over the last 10 years, we remember that the stock market more than doubled. We forget, however, the issues that investors had to deal with along the way.

In every year of EdgePoint’s history we dealt with alarming and uncertain events. In 2009, we were still facing the uncertainty around the U.S. financial crisis. In 2010, we had a European debt crisis. In 2011, the U.S. government debt was downgraded. And so on, and so on…Over this 10-year time frame, investors who stayed the course were rewarded with pleasing returns.

There will always be good reasons not to invest. As long-term owners of high-quality businesses, we believe it’s usually a mistake to sit on the sidelines waiting for a brighter future.

Uncertainties over the last decade

Brexit

End of commodity super cycle

North Korea

Rise of populism

Negative interest rates

Inflation, deflation

China slowdown

Trump

Natural disasters

3) The ride won't be smooth

There will be more volatility in the future.

Equities have proven to be the best way to build wealth over the long term. However, the trade-off for earning higher returns is that you have put up with a bumpier ride.

What is a normal level of volatility? Over the past 90 years, the average annual drawdown for the S&P 500 Index is 16%.iv This means in a “normal” year you shouldn’t be surprised to see the market decline 16% from the highest point to the lowest point. Of course, 16% is just an average, which means that in some years the decline might be a lot worse.

Until recently, investors have been experiencing a perfect environment. Stock market returns had been strong and there was little volatility. Between 2012 and 2017, the average calendar year drawdown was just 8%,v well below the long-term average.

S&P 500 Index calendar-year maximum declines

2008 to 2018

Source: Bloomberg LP. Drawdowns measured in local currency and are price returns. Annual drawdown refers to the largest intra-year peak-to-trough drop during a calendar year.

During the last few months, the media has been treating recent market volatility as unusual. The truth is this is normal. In fact, volatility never goes away – it merely goes into hiding – something we emphasized in our 2017 fourth-quarter commentary.

If volatility is a constant, what can we do about it?

If you believe that volatility is risk, you will probably sell stocks at the first sign of a market correction. Unfortunately, you are trading off long-term returns for a little bit of short-term comfort.

If you believe volatility is opportunity (which we do), you will use it to capitalize on other people’s mistakes.

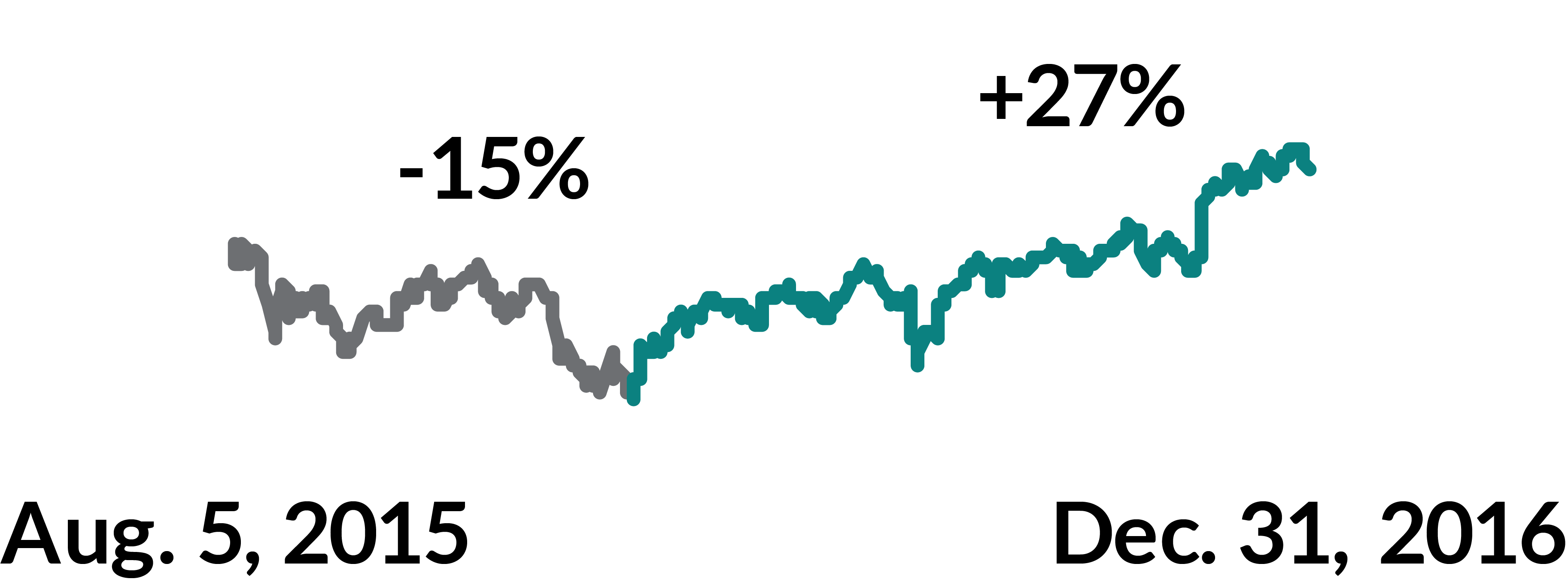

Let’s walk through what we did during the most volatile periods of the past 10 years. Before the recent market downturn, there had been four periods in EdgePoint’s history where our global portfolio declined by at least 15%.

Take a look at the chart below. The global portfolio was down 22% at one point in time during 2009 (Period 1 in the chart). Instead of going to cash or hiding out in “safety stocks,” we used the volatility to increase our stakes in 20 of our existing portfolio companies. We get excited when we can buy businesses that we already own at much lower prices. The total return for the entire Period 1 was 26%.

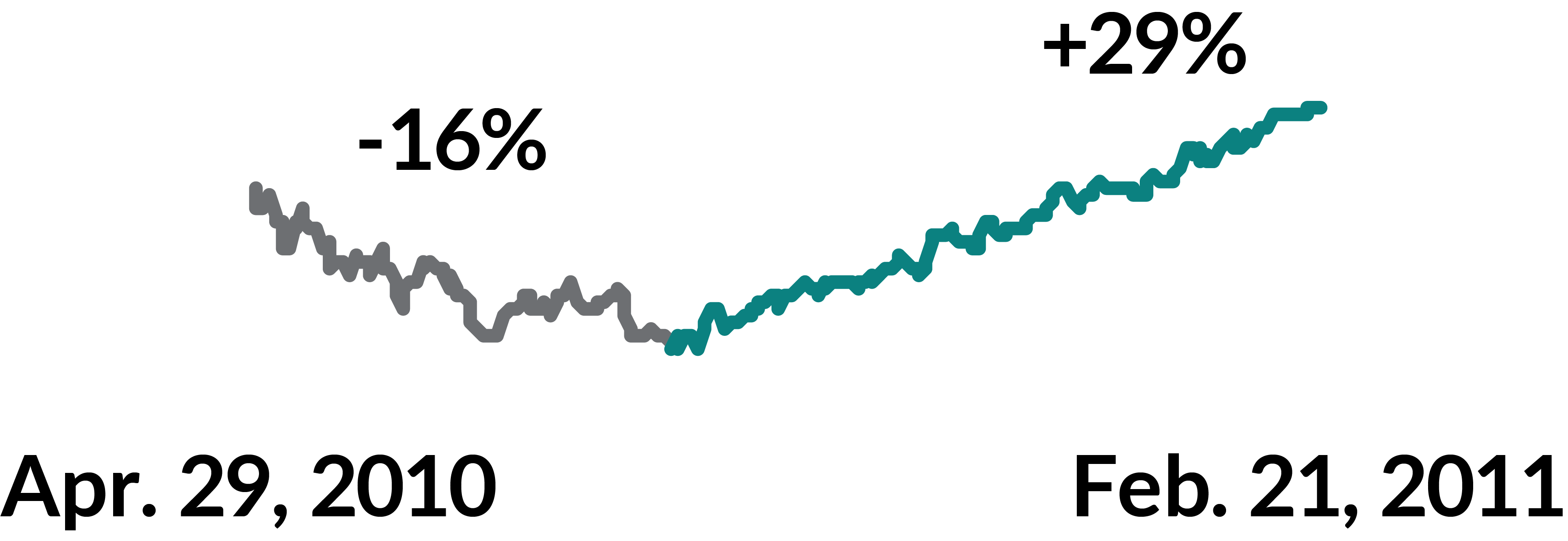

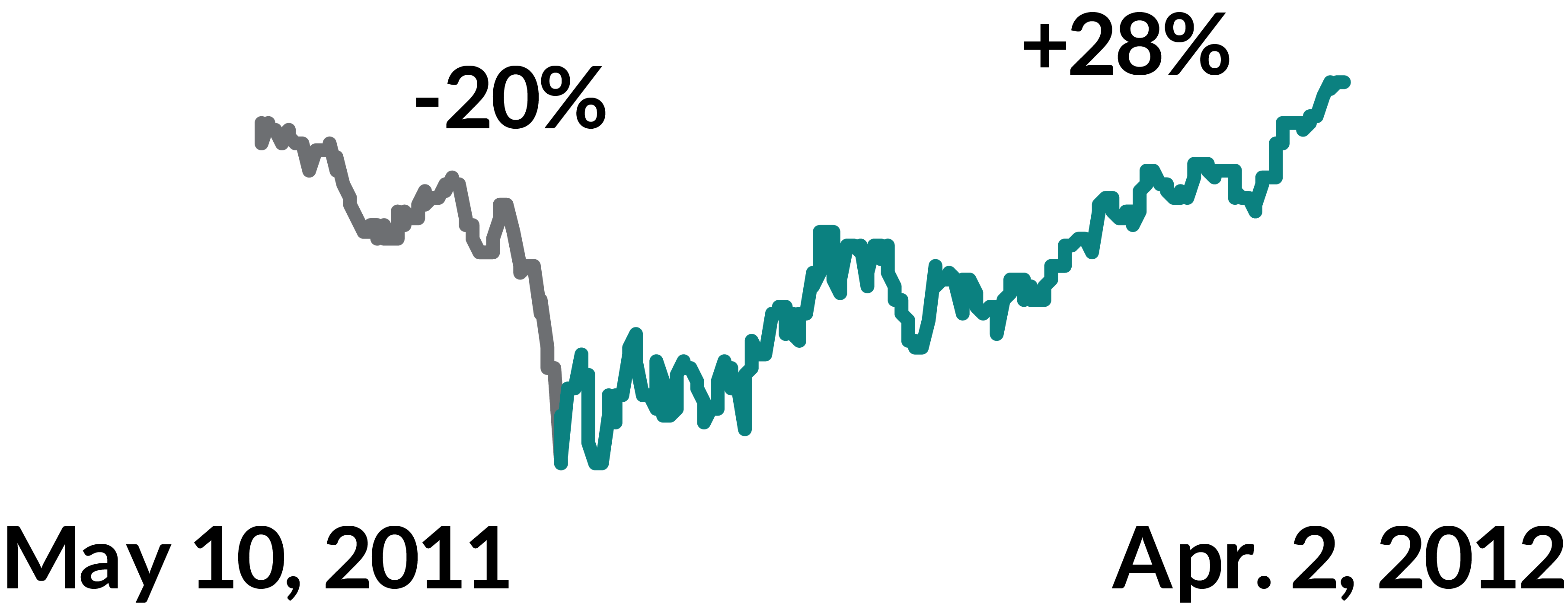

The decisions made by the investment team during each period contributed significantly to our long-term returns. Since inception, the majority of our outperformance versus the index came from the four recoiling periods.

Period 1

Total return 26%

Period 2

Total return 8%

| Activity | Portfolio activity during drawdown (# of companies) |

|---|

| Activity | Portfolio activity during drawdown (# of companies) |

|---|

Period 3

Total return 3%

Period 4

Total return 8%

| Activity | Portfolio activity during drawdown (# of companies) |

|---|

| Activity | Portfolio activity during drawdown (# of companies) |

|---|

Performance as at December 31, 2018. Annualized total returns, net of fees, in C$

| YTD | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception |

|---|

That was then – this is now

Over the past three months, the EdgePoint Global Portfolio has declined by -12%.vi The actions we have taken during the recent period are consistent with what we have done in the previous four downturns.

At the end of September our cash weight in the EdgePoint Global Portfolio was 13.3%, and by the end of December it was down to 2.5%. We used the market volatility to increase our position in 15 (or 38%) of our existing portfolio names. We also found two new businesses to buy.

Of course, no one really likes volatility (even though we enjoy the attractive opportunities that arise from it). Bad things will happen and when they do, investors will get scared.

Try to remember that without volatility, there would be few chances to buy outstanding businesses at attractive prices. In order to achieve pleasing long-term returns, we need the occasional market correction.

4) We will seek to find an unfair advantage

The only way to beat the market is to have an “edge.”

The stock market is one of the few fields where consensus thinking usually leads to poor outcomes. For example, if you need a knee operation, you would probably consult the top-five knee specialists for advice. If all five surgeons recommended the same procedure, you would be wise to follow their advice.

Similarly, if you were going to build a bridge you would seek out the five best civil engineers. If they all recommended the same approach, you should probably listen to them.

Now, if you were to ask the five smartest economists about the direction of the stock market and they all have the same view, history suggests they are probably going to be wrong!

In the stock market, the collective view of the investing public is already reflected into the current price. As the saying goes, if all you know is what everyone else already knows, you don’t know anything at all.

The only way to get an edge is to have a view about a business that isn’t widely shared by others. We call this having a “proprietary insight.” Over EdgePoint’s history, we’ve looked for businesses that can be a lot bigger in the future where we aren’t being asked to pay for that future growth.

That was then – this is now

How do we ensure that we maintain our investment edge over the next decade?

Our biggest edge has been, and will continue to be, our extended time horizon – the willingness to look further out than other people, even if we may look wrong in the short term.

In the past, the average investor held a stock for two or three years. To get an edge, one had to look out four or five years. Today, investment time horizons have shrunk dramatically to months, if not days or even minutes. Having a view about what a business will look like two or three years from now can be a distinct edge.

Here’s a list of some of the world’s largest companies. Under each name is the average annual holding period. The average shareholder owns Amazon for a little over three months. Jeff Bezos makes decisions today that will only payoff many years into the future. Yet the average Amazon shareholder is only willing to wait around for the next quarterly earnings report, if that.

Owning a business for three months sounds crazy because it is!

| Amazon.com, Inc. | Apple Inc. | Facebook, Inc. | JPMorgan Chase & Co. |

|---|

The shorter people’s investment horizons are, the greater our long-term advantage.

We previously discussed that the average investor consistently performs worse than the funds he or she is invested in. As a result of buying high and selling low, the “investor behaviour gap” is an unfortunate reality in our industry.

As you can see in the chart below, the average EdgePoint investor has earned virtually the same return as the underlying funds over the past decade. We believe this is a testament to the quality of our investors and their advisors who understand the benefits of disciplined long-term investing.

Ten-year annualized returns by Portfolio

As at December 31, 2018. Source, EdgePoint Portfolio returns: Fundata Canada, net of fees. All returns annualized and in C$. Source, average EdgePoint investor returns: CIBC Mellon. Average EdgePoint investor returns are the average money-weighted returns net of fees across investors who held EdgePoint Portfolios, Series A from December 31, 2008 to December 31, 2018. EdgePoint Portfolio returns are time-weighted to best reflect the manager’s performance based on compound growth rate, which isn’t impacted by portfolio cash flows. Money-weighted average investor return takes into account the investor’s decision(s) regarding the timing and magnitude of cash flows and represents their personal rate of return.

We are fortunate to partner with a group of like-minded advisors who understand that the following things will never change:

Investor behaviour

The future will always be uncertain

The ride won’t be smooth

We need to have an edge when investing

You let us take the long-term view when other people get caught up in the short-term noise. You also provide us with more capital to invest during periods of volatility.

Over the next 10 years there will be events that we can’t predict and times when it will feel more comfortable to sit on the sidelines. However, focusing on the things that won’t change will hopefully keep you grounded and give you confidence to stay the course.

Thank you for your continued trust and support. We work hard every day to be worthy of it.